Libra clients will know that we do Sector and Market analysis like nobody else does it because we do everything from the granular bottom up level stock (company) level to assess the value, growth, sentiment and uncertainty and then aggregate up that information that offers sector and market perspectives.

It’s the big calls that make the big difference to both Equity and Cross Asset investors and we’ve been doing this successfully for years.

When we bring these ‘ Need to Know’ moments to the attention of clients they know that, relative to history, where the price trades in relation to value – the Alpha available – but they can simultaneously visualise their Risk of loss.

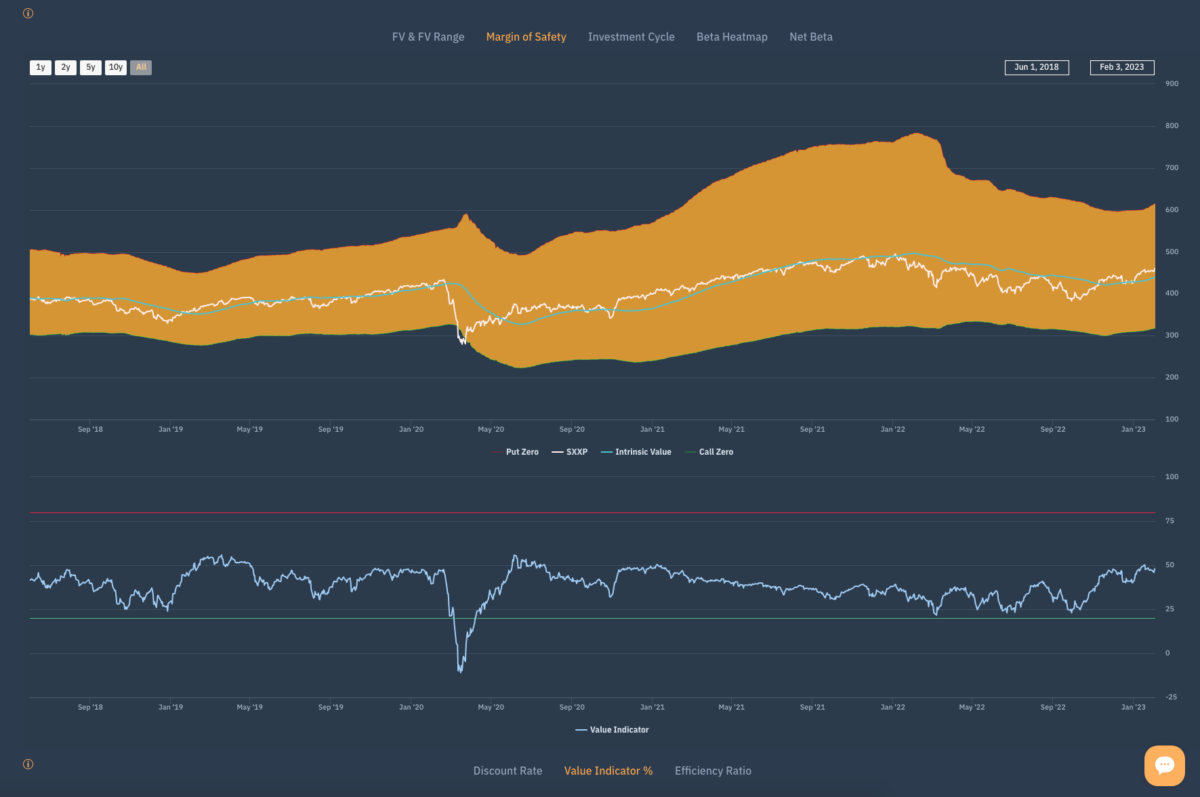

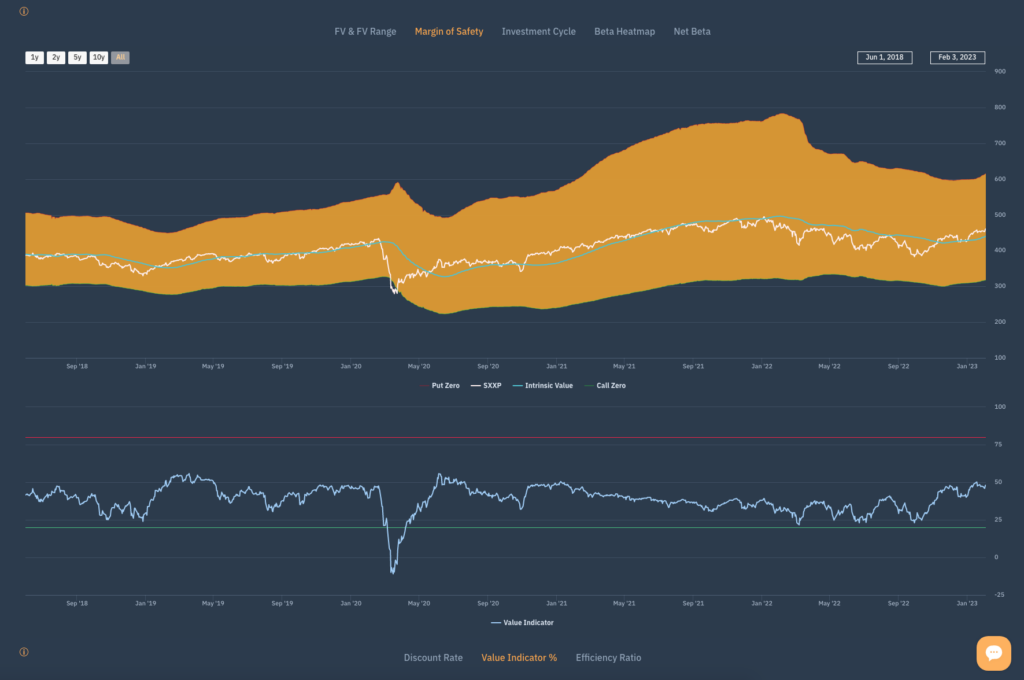

In late September last year we alerted clients to the opportunity to buy the Stoxx 600 and the S&P 500. The chart above is the Margin of Safety chart for the Stoxx 600 and highlights the discount to the expected return and the risk being priced in at that time.

At this point, following a 17% return the same chart suggests that we are now in for a period of consolidation at best or correction.

We recommend investors go to the Apollo EDGE platform and seek out stocks that look expensive relative to history because they are there and consider weeding them out. History suggests that growth expectations will need to rise (which they might) from this point to catch up with share prices that in many cases have risen dramatically.