Apollo has been known as ‘The Need To Know’ since inception in 2004 for good reason. Investors armed with information and insight make smart decisions that maximise the chances of a positive outcome. Now we bring these insights to ETF investors and distributors.

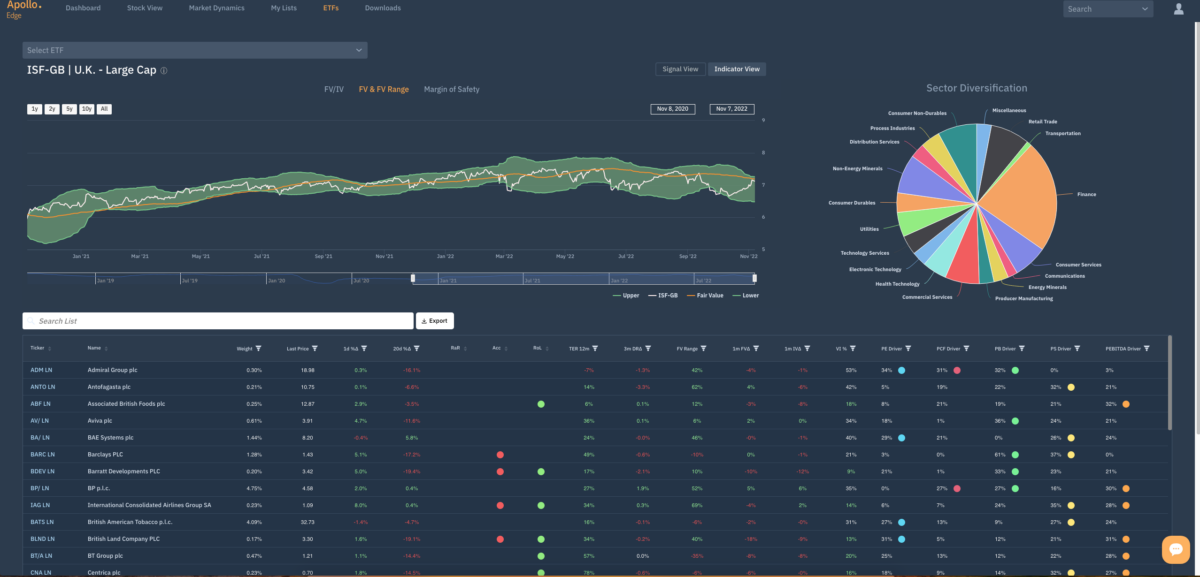

Valuation from the bottom up has always enabled us to aggregate stock information to really do Top Down from the Bottom Up. This methodology has delivered an unrivalled perspective on sectors and markets for many years. Apollo provides valuation, signals and indicators that reinforce that decision making process across stocks, sectors and markets.

From this point, it was only a question of time before we used the same methodologies, signals and indicators to enhance the investment world of ETF’s providing the Apollo overlay so that investors can genuinely understand the potential for gains but critically the risk of loss.

There is no doubt that transparency is becoming a buzzword with reference to ETF’s and ESG and by all accounts these products and themes are only growing. Apollo provides that transparency which must be the holy grail for Professional and Retail investors.

Another element of transparency is something we can come back to another day – ensuring that the constituents of the ETF or ESG portfolio actually do what is said on the tin. This has become a frustration for buyers and distributors, but working with investors we can select a bespoke universe or theme that contains wholly relevant stocks and then not only provide valuation and signals, but go one step further. Using the Apollo Smart Alpha strategy we aim to ensure outperformance against the peers because performance still counts.