This is just a brief observation at a time when the SXXP is +7% YTD and this year is only 11 days old. The Federal reserve is now perceived to be of a Dovish disposition while the China Opening Up story is now prevalent. Risk assets are on the rise and Copper is back to $9000 / tonne. Maybe we should be buying commodity stocks and copper related names in particular. Antofagasta anyone?

A review of Antofagasta on the Apollo EDGE platform tells a story that suggests as ever that markets can be perfect and in this case, the horse has not only bolted but disappeared over Brokeback (Copper) Mountain.

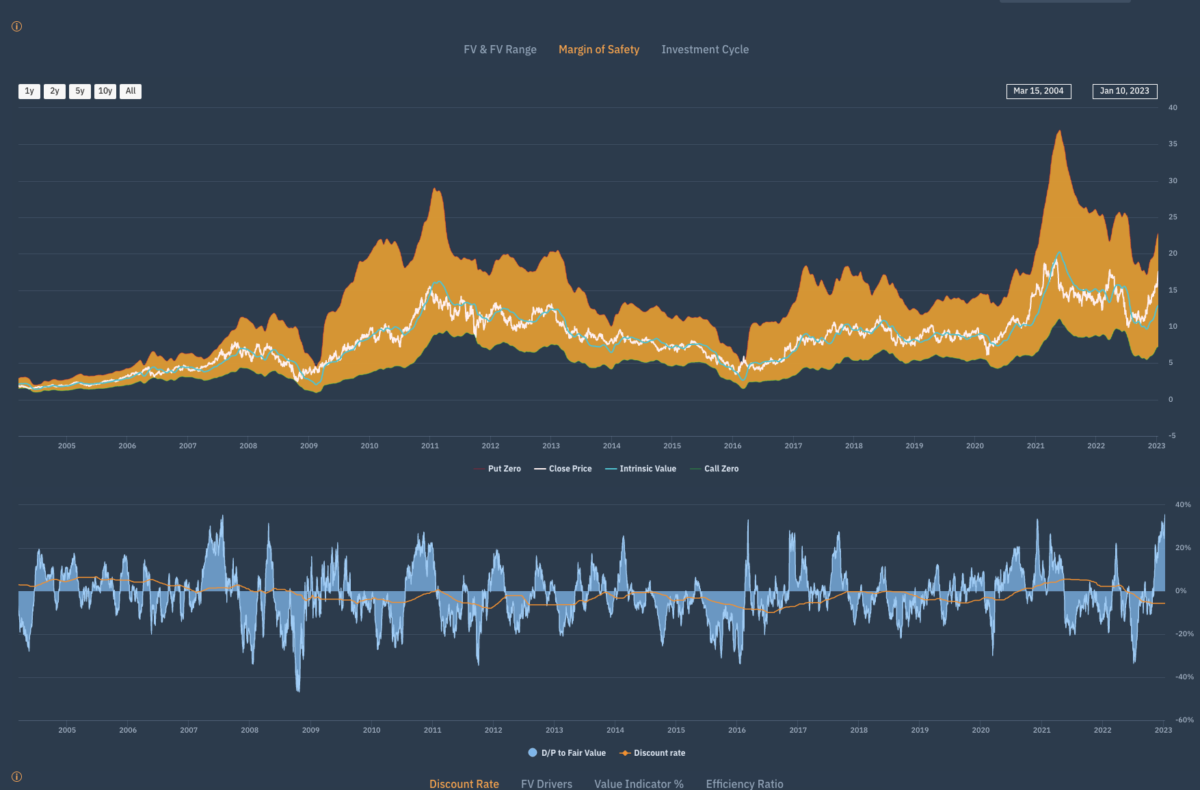

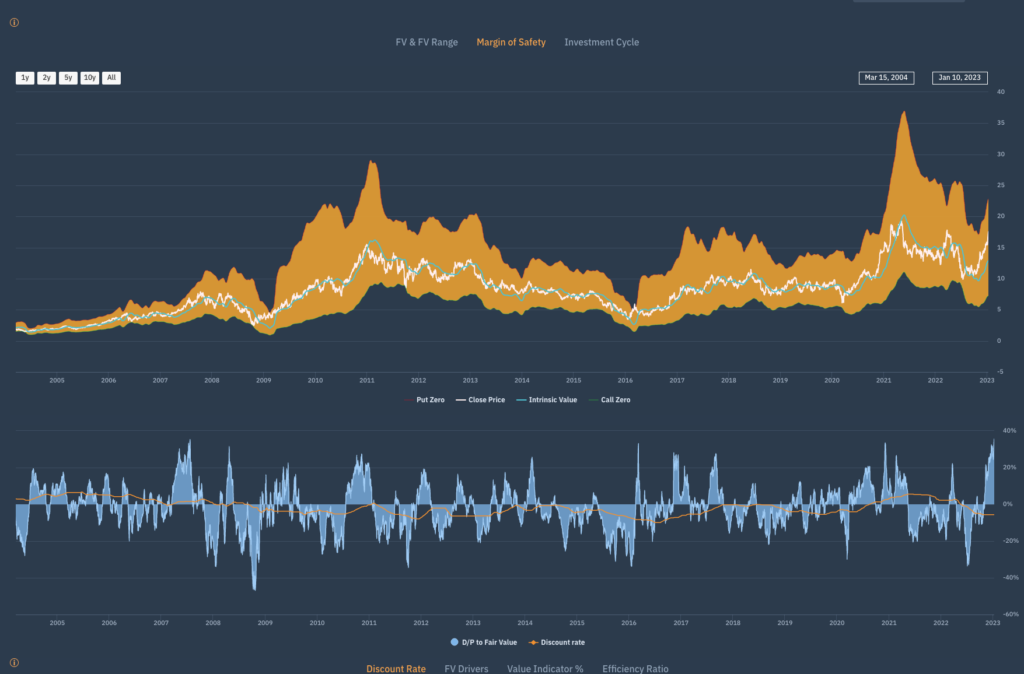

Although slightly difficult to see because the image goes back to 2005, you are looking at the Apollo Margin of safety chart that looks at the relationship between the share price and the longer term expected return (3 years) over time. The lower image shows the discount / premium that the share price has traded in relation to a one year expected return.

What you see is one of many good examples of why investors rely on Apollo.

In July 2022 the discount to FV since we started Libra Investment Services in 2005 has only ever been lower in 2009 – the GFC. In July ’22 (although not shown on this chart) the stock entered our proprietary Value Cycle – a Need to Know moment, particularly if you were looking to buy.

Since then the stock has rallied strongly for reasons mentioned above to the point that the PREMIUM to FV is now trading at the highest we have seen since 2005.

Perhaps it’s worth waiting for the horse to return before buying.