Libra have been doing many things differently and with greater innovation from others for a long time now – offering insight and enabling smart decision to be made using the Apollo investment process. Everything we do starts at a single stock level and shows moments in time when the information set changes and so therefore does the opportunity.

From the information created at a single stock level, through a process of aggregation, we can take that to a sector and market level.

This content has always been sought after by Equity Buy side Portfolio Managers because not only is Macro something that the buy side has always outsourced but this analysis is something that only we have done – sector and market analysis from the bottom up.

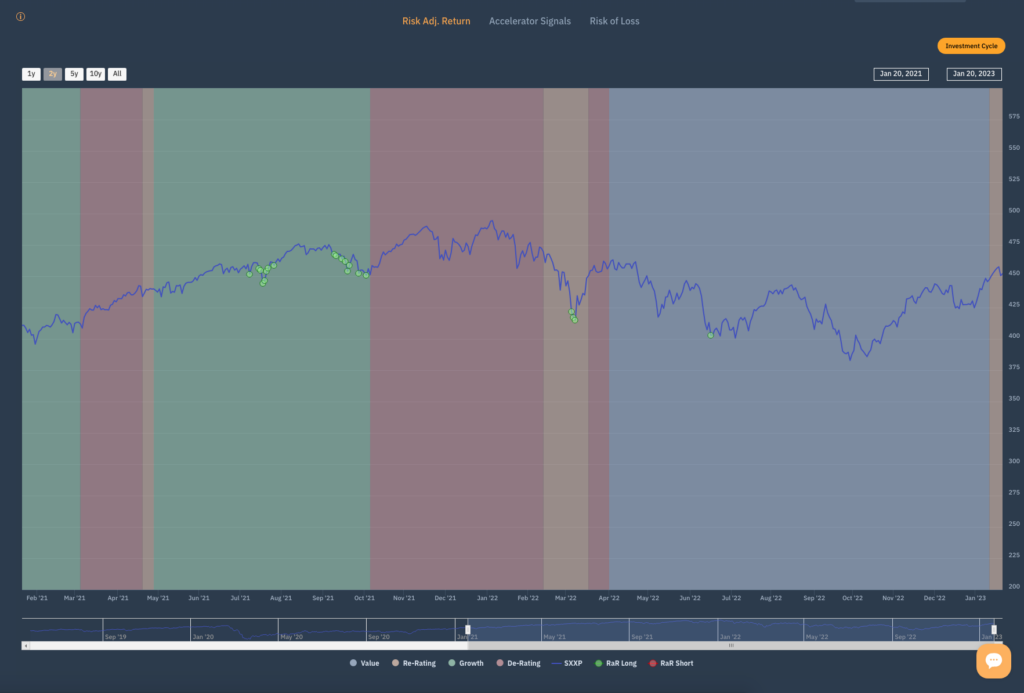

The latest signal / indicator to be added the Apollo EDGE platform has been the Investment Cycle which we discussed in an earlier comment – the ability to show the transition from Value to Re-rating to Growth and De-rating (the cycle) is proving very informative.

Everyday we listen to the Bloomberg Talking Heads give their thoughts about markets based on top down assumptions that effect company expectations without ever referencing where we are in the Investment Cycle based on how the market is pricing future cashflows.

When asked what we think about the market we always have an informed answer based on data – take it or leave it. Now, importantly, that answer to that questioned has changed for the Stoxx 600 and S&P500. Both have transitioned from a Value cycle to a period of Re-rating. For the purposes of this piece we will use the Stoxx 600, but one’s confidence in a market is wholly different between the two periods.

A stock, sector or market that has a re-rating factor categorisation is where the trend in the discount rate that the market is currently applying to the future cash flows of the company (based upon the Apollo measure of implied cost of capital) is clearly falling and likely to persist in doing so. Typically, this occurs when the cashflow outlook for a company is showing some signs of improving and investor confidence is increasing as a result.