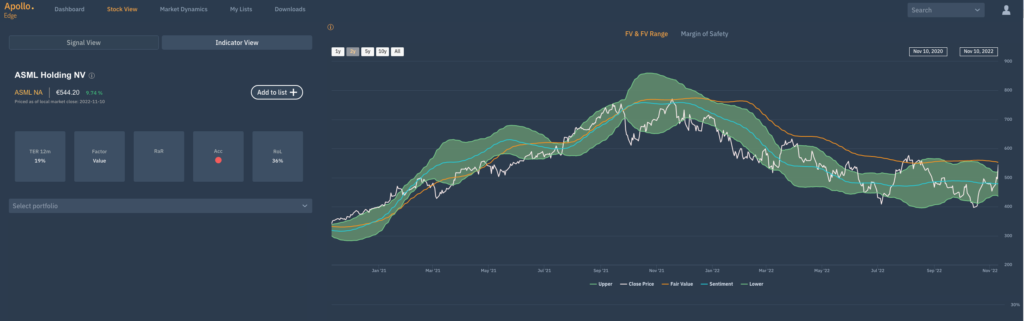

We have been using the phrase ‘back to value’ for many years now, but what does it mean, you ask? The Apollo Present Value (or Fair Value) reflects the expectation of future cash flow based on the median of analyst expectations data, discounted back to today. Apollo is an Implied Cost of Capital model so we estimate the ICC being applied by the Market to those cash flows or looked at another (alternative) way – the discount rate being applied.

In recent months, growth stocks or / and higher beta stocks have been weighed down by a high ICC due to concerns and uncertainty around those expected returns.

Within the Apollo Smart Alpha strategy we have a Value signal that is generated when the ICC is at an historic high, but is no longer rising. These stocks are like coiled springs, where any change in the perception of risk, in a positive way, will see stocks ‘take off’ and return to some equilibrium of risk and this is what happened yesterday following a weaker US CPI number.

These moves have an uncanny although unsurprising habit of seeing stocks return ‘Back to Value’ as you can see from the Apollo chart of ASML. We have been alerting clients to this possibility because adding stocks that have been pricing in considerable risk can be rewarding, while failure to consider covering shorts can be painful. Only days ago, ASML was a slam dunk ‘buy’. After a 12% move in one day it has come back to value and the market will now need to reassess the opportunity.