There are many reasons why our Smart Alpha process works so well and stands up to scrutiny.

We start with the investible universe and immediately ‘knock out’ the stocks we don’t want to own. Stocks are initially selected by Factor – a ‘bottom up’ selection process.

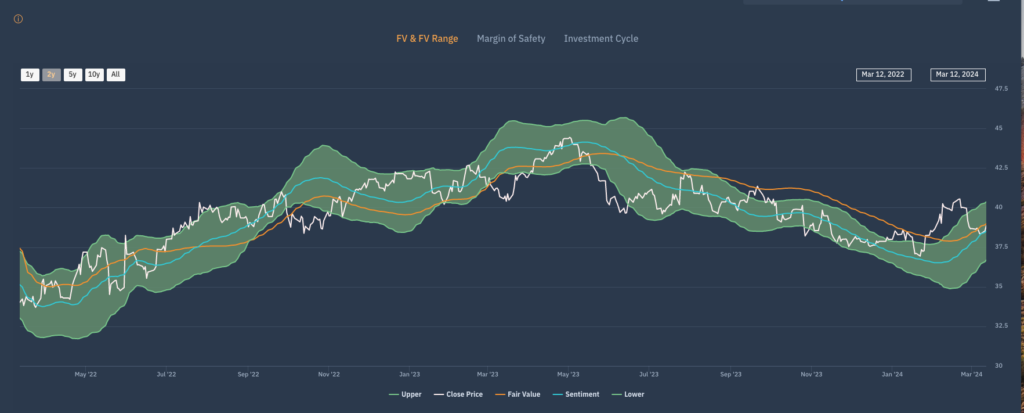

If the fund is long only it involves owning stocks that are in the re-rating, growth and value (where value is likely to see a reversal) buckets. We would avoid High risk growth, de-rating and Junk so the starting point is selecting from stocks that are working and should continue to work. Naturally, It’s worth saying if the fund is Long / Short we select from High risk growth, De-rating and junk so a stock like Unilever (Below) would not be selected for the long only portfolio but could well be selected among the shorts.

Over the years we have been able to provide what clients want – stocks, sectors and market ideas that go up using a systematic process. The holy grail for Hedge funds has always been the quest for short ideas and here we have had a rather different but fully systematic approach than others. Prior to the Smart Alpha process we differentiated longs from short by having Apollo Classics and Stocks on the Rocks. Unilever would be in the Stocks on the Rocks category.

This has now been much refined by the Smart Alpha investment methodology and we wrote a Blog titled ‘Backing the winners’ (https://blog.libra-apollo.com/uncategorized/backing-the-winners/) in late January to show and prove that there was every reason to believe (or no reason not to) that the stocks that do well because they are in the right Factor buckets and have the best expected returns will continue to do so as the chart of Unicredit shows – a winner that continued to win.

Therefore, even after the rally we have seen, the process continues to suggest the losers will remain the losers – Food and Beverage, Telecoms, Utilities and Producers and Household until the evidence tells us otherwise.