Knowing the when the where and the how is a powerful tool within the investment armoury.

All that glitters was gold.

Knowing the when the where and the how is a powerful tool within the investment armoury.

Setting up for the summer. As markets review how they survived the turmoil of the Spring, thoughts turn to summer…

The team here at Libra Investment Services have been analysing global economies and markets for the best part of 40 years and, over that time have seen how the interaction of macro and micro trends, stock level financials and thematic and sector dynamics influence and, ultimately, drive the complex adaptive system that is the financial market. […]

Investing is all about knowledge which is why we have always used the phrase “The Need to Know” when describing what Apollo is and does and h0w it can help investors. Apollo (through the EDGE platform) provides investors an insight which gives them that edge.

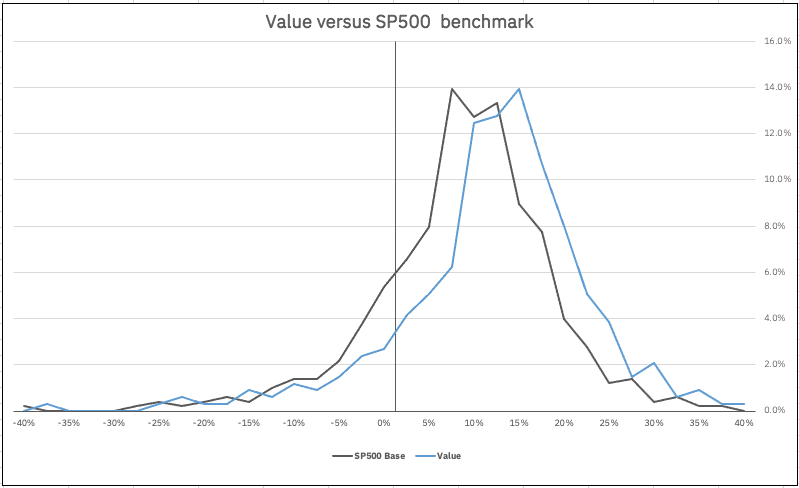

There are many reasons why our Smart Alpha process works so well and stands up to scrutiny.

We start with the investible universe and immediately ‘knock out’ the stocks we don’t want to own. Stocks are initially selected by Factor – a ‘bottom up’ selection process.

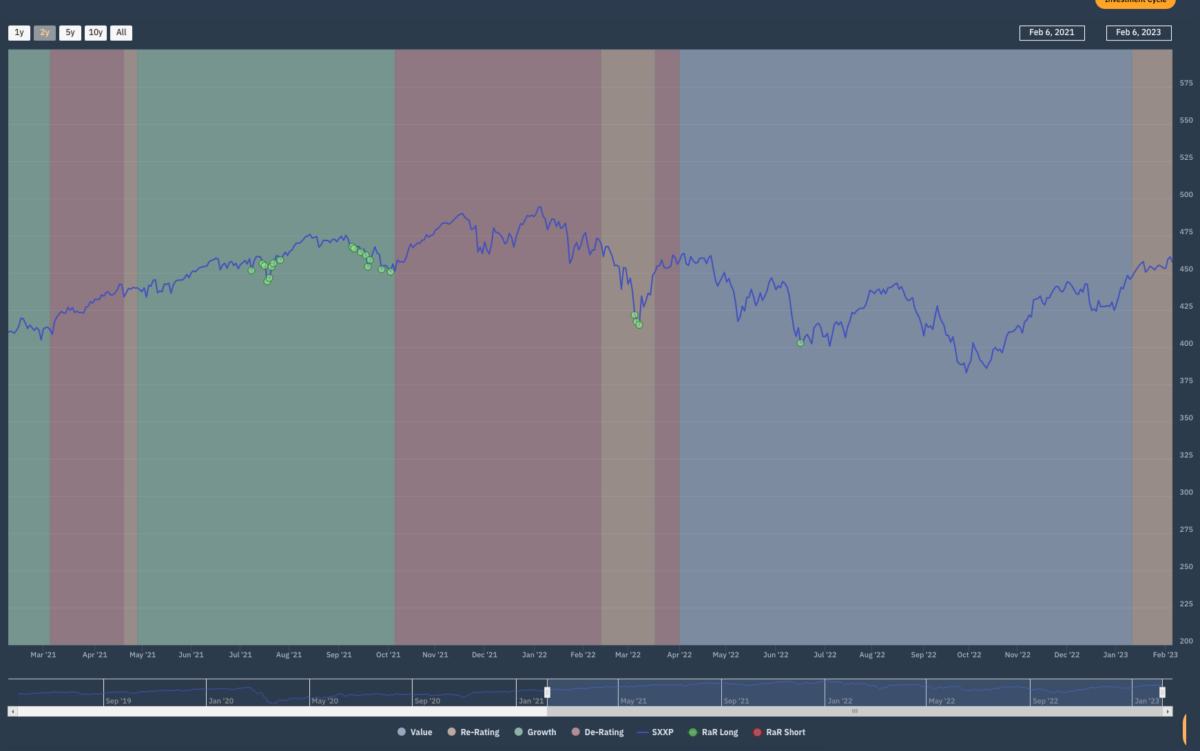

In the Spring of 2022 European Banks started to generate Accelerator long signals, slowly but surely, one by one until the sector itself lit up in a green tinge from April – June and here we are today coming out of a positive earnings season, seeing the sector re-rating.

So, when asked the question ‘Why did you own BP?’ you point at the image of the Apollo Investment Cycle. Answering the more difficult question, ‘Why did you not own BP during the last 2 years ?’ That’s more awkward.

At Libra we think differently and deliver the best user experience for Active equity investors applying the years of experience and understanding that we have in equity markets. We not only know what information is going to make a difference to client performance but provide the best experience.

We have recently introduced a new feature on the Apollo Edge platform that allows investors to “Smart Filter” their portfolios or watchlists at the stock level, using our proprietary investment factor groupings of Value, Re-rating, Growth or De-rating.

Libra Investment Services has spent the last twelve years operating as a research and advisory business to equity market investors worldwide. At the heart of our approach is the idea that equity markets are not a complicated problem to simplify and solve but instead are an open, complex adaptive system to be analysed and understood as much as we can; regardless of their current state of uncertainty or unpredictability.