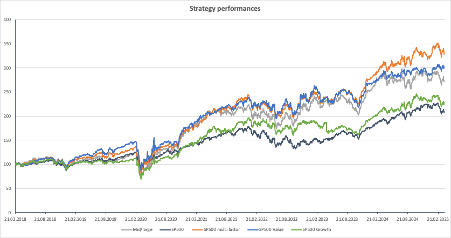

According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

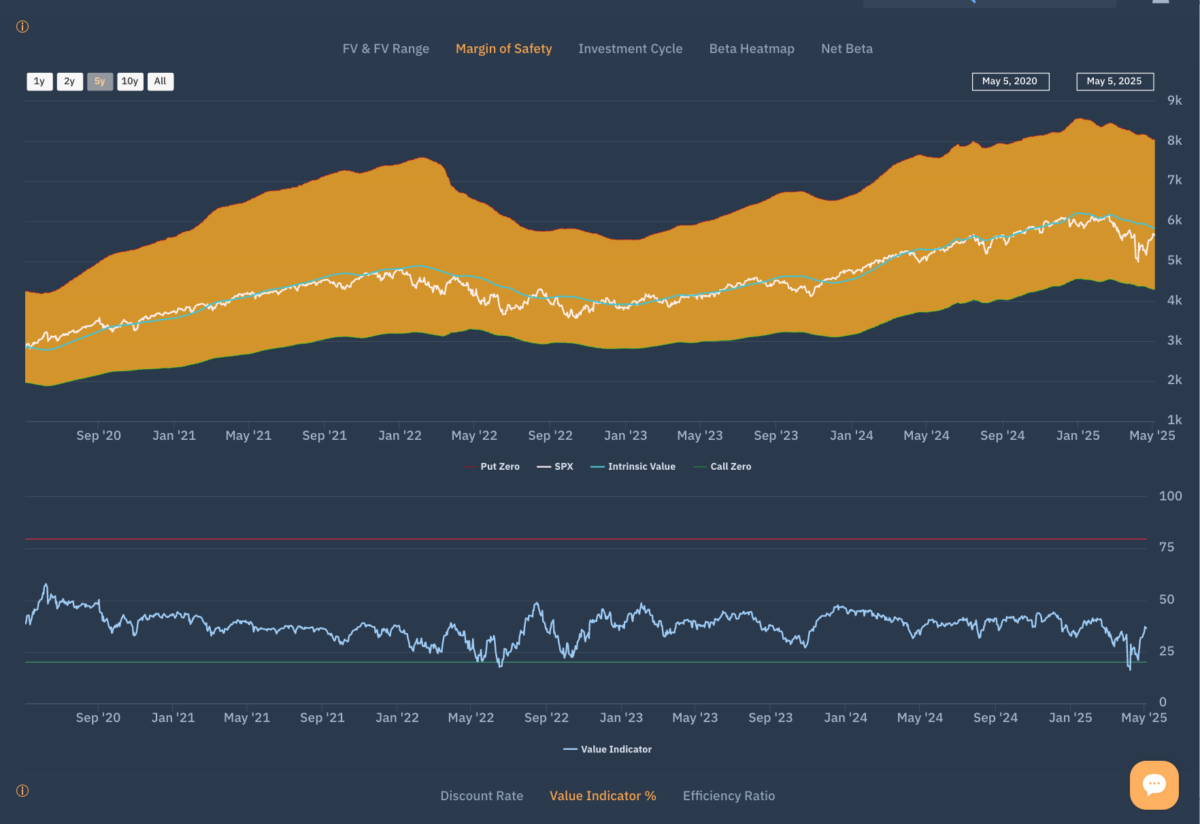

Setting up for the summer. As markets review how they survived the turmoil of the Spring, thoughts turn to summer…

There should be a better conversation about how to manage both risk and reward in equity markets.

Reporting on what has been going on and why is one thing. Knowing what to do about it and when is another altogether.

Everything we do at Libra is from ‘the bottom up.’ The sector and market signals are an aggregation from the signal stock level. Investors can start at the market level and cascade from sectors to stocks to see the best opportunities.

As the (still ongoing) fallout from the market turmoil starts to be evaluated, there has been a natural temptation to rationalise and understand recent activity through the traditional lens of cause and effect: “… (A) market response to an (un)anticipated event occurred because Event X threatened to provoke subsequent (negative) Outcome Y and markets reacted […]

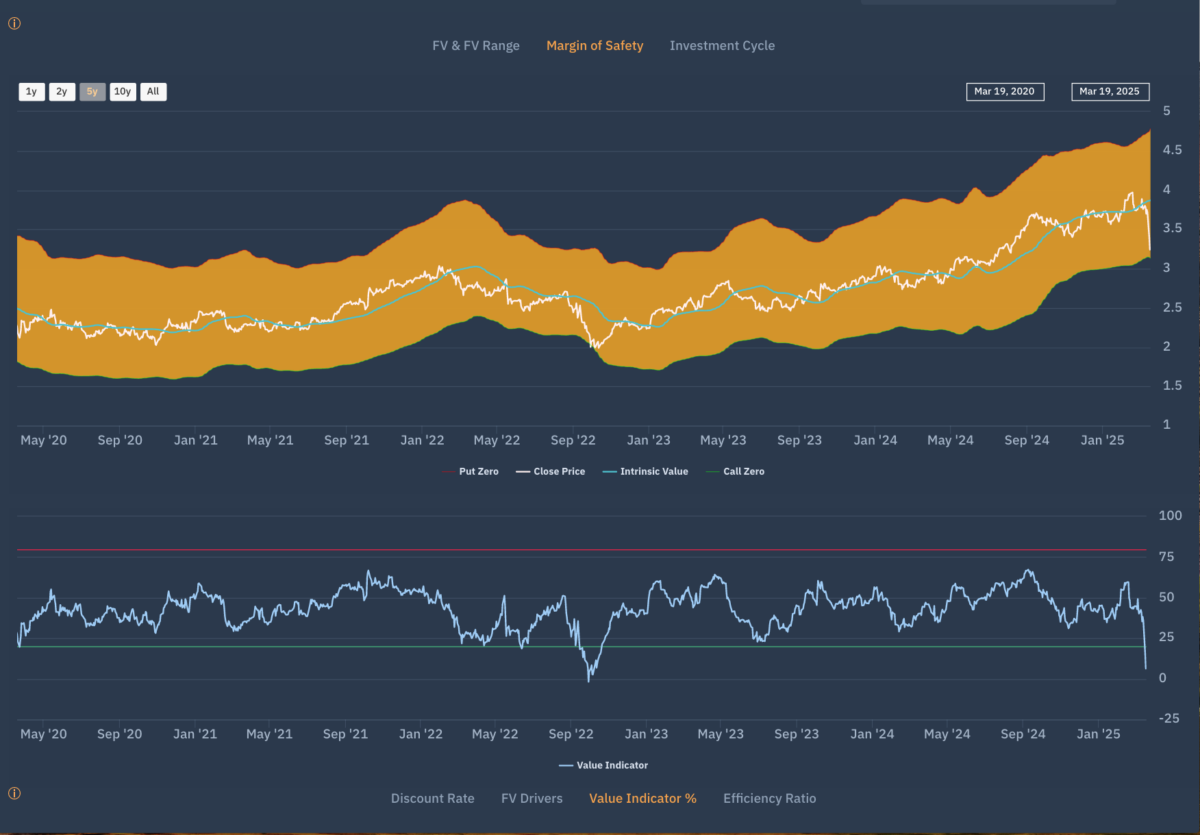

Welcome to the Weather Forecast

As we continue to roll out our Smart Alpha strategies, we are publishing a regular newsletter – the Weather forecast that looks at how Smart Alpha strategies can help navigate the current investment climate.

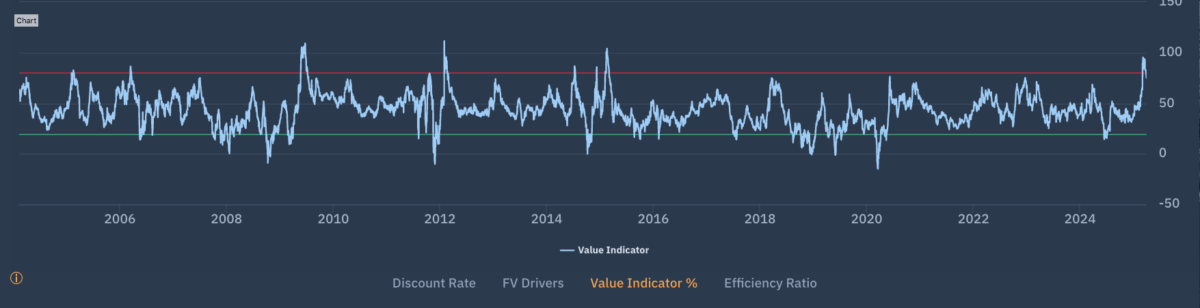

The team here at Libra Investment Services have been analysing global economies and markets for the best part of 40 years and, over that time have seen how the interaction of macro and micro trends, stock level financials and thematic and sector dynamics influence and, ultimately, drive the complex adaptive system that is the financial market. […]

Knowing when to buy a stock is one thing but understanding the risk of loss is another skill altogether.

As someone who has been around long enough to be following Tesco’s stock market journey since the late 1980’s I found myself bemused by the share price reaction to the news that Asda was on the verge of announcing a price war. Over the years we have got used to price wars, particularly the threat […]