Putting a risk managed portfolio together

In a previous post I introduced the idea of building a “pure alpha”, Long/Short portfolio for US equities where the short leg (hedge) used was a short position of the S&P500 itself. The idea behind this is that, so long as your stock selection (of, say 50 stocks) produces reliable alpha, then by taking a short position in the overall index, you can literally hedge out the negative tail-risk exposure to the market (by hedging out the market beta) in a way that will always be non-correlating to your long position. The evidence of how this would have worked in recent months was compelling – particularly when it had become apparent that Bonds had offered no protection to the recent market drawdown, rather begging the question “…What role, in fact did the “40%” actually play in helping the risk management of the average investor 60/40 portfolio?” Not a lot, it would seem.

The beauty of this Beta-hedged pure alpha approach, of course, is that it means for portfolio construction purposes, you don’t actually need to hold a position in Bonds at all if you don’t want to. The classic 60/40 portfolio can be constructed from a long only position in a basket of equities, whilst the 40% can be provided by utilising a 100% hedged Long/Short equity portfolio. (The extent of the effective hedge (60/40, 80/20 etc) will depend on the exact composition of the long only basket, the frequency of exposure rebalancing and other factors such as liquidity, but the principle stands.) This will not only provide the non-correlating risk counterpart of the equity portfolio but (by incorporating a cash component in the portfolio) will allow the degree of tail-risk hedge to be adjusted independently of the size of the long position taken. So 60/40, 80/20, 90/10 are all possible simply by adjusting the size of the short position.

Only Equity…

This Equity only approach to portfolio construction would appear to go against the grain of the multi asset industry. However, when Quant firm AQR conducted a recent report looking at Strategic Asset Allocation (SAA) across a range of portfolios they came up with some interesting conclusions. In their examination of current practice in terms of SAA, they started from the following premise:

“To implement any SAA framework, an investor must first specify either a primary return objective (to be achieved with minimum risk) or a primary risk constraint (within which to maximize expected return).”

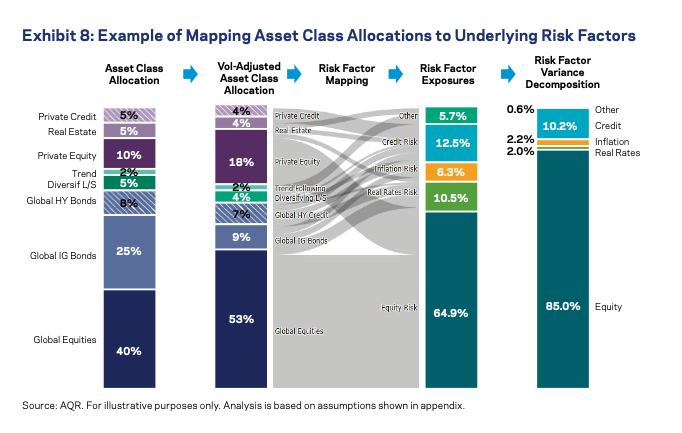

Taking a typical institutional Multi-Asset Class based allocation (40% equities, 25% IG bonds etc.), AQR’s Portfolio Solutions team applied a Factor based risk mapping approach to the SAA problem. A clear benefit of this approach is that it allows for the estimation of the impact on a portfolio of shocks to specific high-level factors such as Credit risk, Real interest rates, FX exposure, inflation etc. By translating capital allocations to risk allocations and then mapping these to underlying risk exposures before finally calculating their contribution to overall portfolio risk, the inherent level of overall risk exposure can be quantified with respect to high level factors as well as at the asset class component level.

Having run the analysis, they identified that:

“For this seemingly diversified portfolio with just 40% of capital allocated to public equities, a whopping 95% of portfolio risk is driven by correlated equity and credit risk factors. For this factor allocation to be optimal,

95% of expected return would have to come from these factors too.”

What this implies is that the Multi Asset class diversification of returns doesn’t seem to provide a credible diversification of risk at the portfolio level. The key takeaway is that it is equity risk that dominates traditional portfolio risk, and it is therefore management of equity risk that provides the major risk focus (and constraint) for investors – regardless of the composition of the return drivers.

AQR’s observation that, in order to be optimal, “…95% of expected return would have to come from these factors” reveals a singular truth: If a SAA is to achieve its goals of being properly risk managed, then yes, that is the required outcome.

Risk management within Equities

From the investor perspective, AQR’s observations imply that if portfolio risk is not actually diversified away from Equity risk (or correlated credit risk) by using a Multi-Asset class approach, then investors should seek to maximise their return by simply owning an equity portfolio that facilitates the SAA’s requirements; simply mapping both sets of AQR’s investor objectives/constraints – on both the returns and the risk management side – to a pure equity portfolio.

From this point it becomes clear that Portfolio Risk Management becomes a function of the equity portfolio construction process itself. Note that this is a function that Passive Equity Market Investment cannot provide – in fact quite the opposite. Risk exposures in passive products are primarily dictated by index construction rules so that country, sector, factor or stock level exposure is not normally considered from a risk perspective at all and therefore cannot be risk managed within the (passive) equity portfolio itself. The whole Mag-7 situation revealed this as an unmanageable risk consideration in recent months alongside increasing concerns about the dominant exposure of most investors to US equities due to the 65-70% exposure to US stocks in the MSCI world index. The best that one can hope for is that a selection of independently determined indices or ETF’s can be combined in such a manner as to ensure a degree of exposure control. However, that becomes active management using passive products but limits the ability to balance risk and return.

Active management makes sense for risk

For an active risk management approach, the selection of stock level assets, factor exposures, country or market exposures all become part of a risk adjusted, expected return process where the risk component is an integral part of the system. This in turn requires a regular review of risk and return across both a selected portfolio of stocks and the underlying investible universes from which they are selected. Unlike an expected return driven, long only methodology that focuses upon a relatively long-term return horizon, the focus upon both risk and return means that such reviews need to be relatively frequent; a two-month rebalancing window for stock selection and factor exposure is deemed by Libra to be an optimal time frame and is a common feature of our Smart Alpha model.

We can break the risk management process down into takes two broad forms:

- risk diversification

- risk mitigation.

A relatively diversified portfolio in terms of number of positions is the norm in most long only portfolios which helps to diversify stock specific risk, but within a listed equities portfolio, diversification of Investment Factor exposures also benefits risk management. This can take the form of a long-short equity portfolio – long Quality, Short Junk for example – but it can also take the form of explicit factor selection within a portfolio construction approach. Choosing not to own Junk or high-risk Growth stocks in a long only portfolio but equally weighting exposures to Growth, Quality and Value would achieve the same effect of factor diversification and, again is part of the Smart Alpha methodology.

The opportunity for risk mitigation comes in the form of a positive selection of what might be considered trend following strategies based upon a combination of short term, longer term, and economic trend signals. Again, this is Smart Alpha. Systematic, active portfolios that seek to capture stocks where uncertainty in terms of expected returns is declining but where momentum in terms of expected returns is accelerating are an effective way to ensure that risk mitigation is embedded in the stock selection process from the outset.

To quote AQR again:

“ Investors’ desire for high returns, combined with their aversion to leverage, suggests that pro-growth/equity-centric portfolios are here to stay…trend-following strategies deserve significant attention given their ability to deliver positive long-run returns and outperform in both growth- and inflation-driven equity drawdowns. They also outperform other risk mitigators during slow/ long drawdowns—the very types of drawdowns that most impair an investor’s ability to achieve long-run return objectives. Not all trend-following strategy implementations are created equal, however. In contrast to conventional wisdom, signal diversification across short-term price, long-term price, and economic trends, and the inclusion of niche alternative markets provides the most robust return and equity protective property profile.”

The final step in the risk management process is the degree to which we can add our pure alpha, long short strategy to mitigate Equity market tail risk. By taking a long only position in a positive trend strategy consisting of a set of positive, factor-diversified stocks selected from the S&P500 and then shorting the SP500 index directly against it provides an effective beta hedge against the tail risk of equity market sell-down. So long as the trend following strategy generates persistent alpha ( Spoiler alert – it does) the impact of Market Beta is hedged out without the persistent loss of other hedge structures such as options. This provides a form of risk hedge against the kind of extreme events seen in April 2025 as it effectively takes on the non-correlation role that the Bond component of a traditional portfolio was supposed to do (but didn’t) in the face of the “Bear Market” scenario.

Putting it together

The conclusions that we can draw from this are as follows. For an investor where the core component of their investment portfolio is in listed equities, diversification of exposure across multiple asset classes for risk purposes does not achieve any risk diversification away from equities. From a return perspective, however, it does lead to lower set of expected returns. If ,instead of using the multi-Asset building blocks of traditional portfolios one took factor specific, internally risk-managed equity building blocks instead, then the pure equity approach provides a means of mapping both active risk AND return at the portfolio level in a way that neither passive nor multi-asset approaches can.

Provided that equity exposures and hedges can be constructed at the portfolio level in such a way as to both diversify and mitigate equity risk and return in a singular process, the twin aims of targeting a primary return objective (to be achieved with minimum risk) and setting a primary risk constraint (within which to maximize expected return) can be achieved simultaneously.

From the initial start point of the two block portfolio using Large Cap trend-following US equities and pure Alpha US (US large Cap hedged) to mimic a risk-managed 60/40 portfolio for example, a combination of just five equity building blocks – Large Cap US equities, pure Alpha US (US large Cap hedged), Large Cap Global equities, a basket of US Mid/Large cap Value stocks and a basket of US Mid/Large Cap growth stocks would provide all that was required for a US centric equity investor to diversify a systematic but positive, trend following and risk managed portfolio across size (mid/large cap), Country (US/Global), Factor (Value/Growth) in a systematic, coherent and integrated manner.