According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

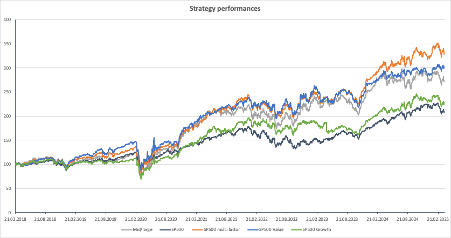

Setting up for the summer. As markets review how they survived the turmoil of the Spring, thoughts turn to summer…

Portfolio construction needs to be about both a managed process of risk and return – not about multiple risks and multiple returns

There should be a better conversation about how to manage both risk and reward in equity markets.

One reason that we call this report “The Weather report” is that the analogies with multiple elements of Value, Momentum and Uncertainty impacting markets in a continuous way chimes with the idea of Currents, Tides and Winds, all impacting the navigation of the high seas. Whatever the nature of the vessel concerned or the skills, experience […]

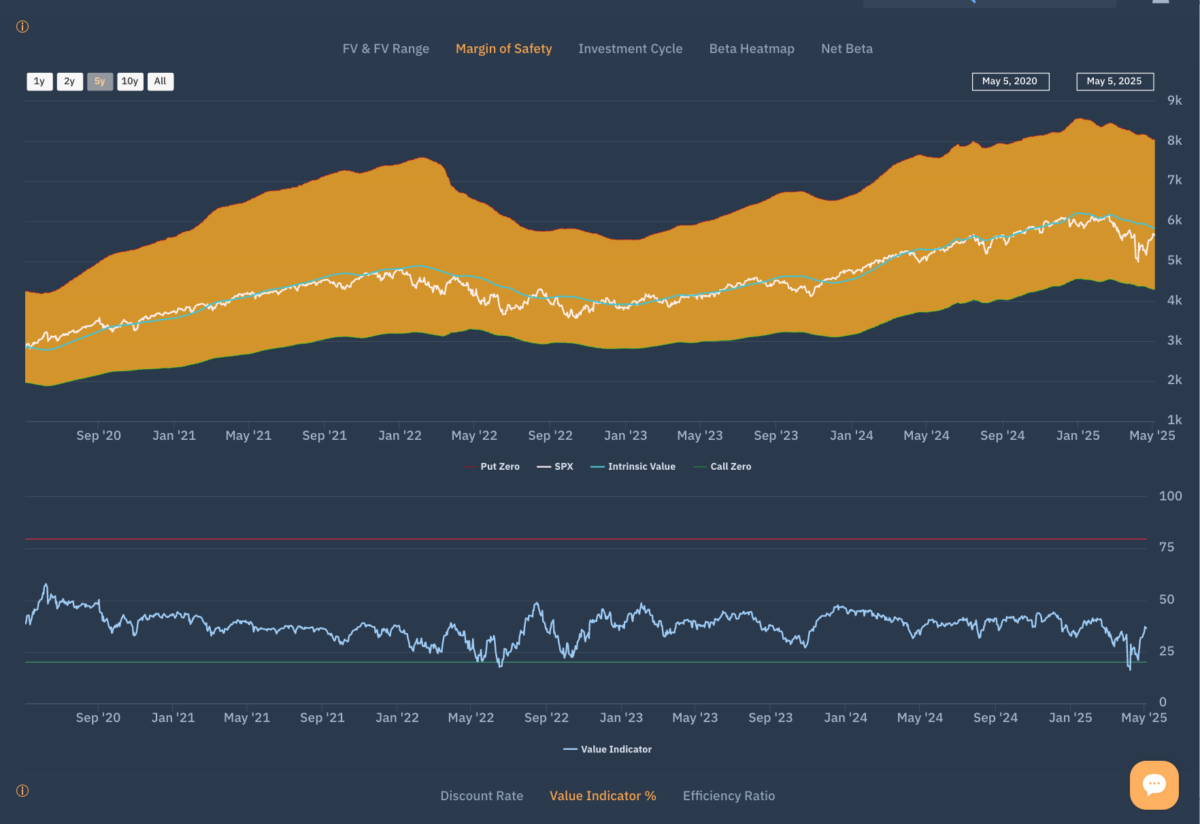

Reporting on what has been going on and why is one thing. Knowing what to do about it and when is another altogether.

In the world of data – quality is everything. We have now made Apollo data even more accessible and user friendly as the whole database can now be delivered seamlessly to your workflows via Snowflake – a data warehouse built for the cloud.

Everything we do at Libra is from ‘the bottom up.’ The sector and market signals are an aggregation from the signal stock level. Investors can start at the market level and cascade from sectors to stocks to see the best opportunities.

As the (still ongoing) fallout from the market turmoil starts to be evaluated, there has been a natural temptation to rationalise and understand recent activity through the traditional lens of cause and effect: “… (A) market response to an (un)anticipated event occurred because Event X threatened to provoke subsequent (negative) Outcome Y and markets reacted […]

Welcome to the Weather Forecast

As we continue to roll out our Smart Alpha strategies, we are publishing a regular newsletter – the Weather forecast that looks at how Smart Alpha strategies can help navigate the current investment climate.