Entering into February, we take a look back at the weather report for January 2026 and take a view on what might lie ahead in H1.

Entering into February, we take a look back at the weather report for January 2026 and take a view on what might lie ahead in H1.

As global equity markets look ahead to the coming year, we summarise the year that has gone and look forward to the New Horizons of 2026 through the lens of Apollo.

Catfish season… We call our regular Apollo based commentary “The Weather report”. The analogies that we can make with the multiple elements of Value, Momentum and Uncertainty impacting markets in a continuous way chimes nicely with the idea of Currents, Tides and Winds, all impacting the navigation of the high seas. Whatever the nature of the vessel […]

Do traditional market patterns still matter in the age of AI and the 2025 surge in retail investor flows? As we enter November, we review what Tail winds might persist into year end.

As summer ends, we move into more autumnal conditions in the markets. Things remain relatively stead but we can expect a pick up in the weather ahead as corporate reports and macro factors start to set the course to year end.

Beyond the weather report, the other essential maritime document is the Nautical Almanac. In many ways, a form of Market Almanac could be a useful addition to the information system for investors and the following document is a version of it, based upon the Apollo view of the markets.

As a slowing July Market looks towards August with a few concerns about overvaluation and falling momentum, we remain relatively unfazed. Our portfolios are consolidating from a good first half so we will be looking towards our mid-August rebalance with interest.

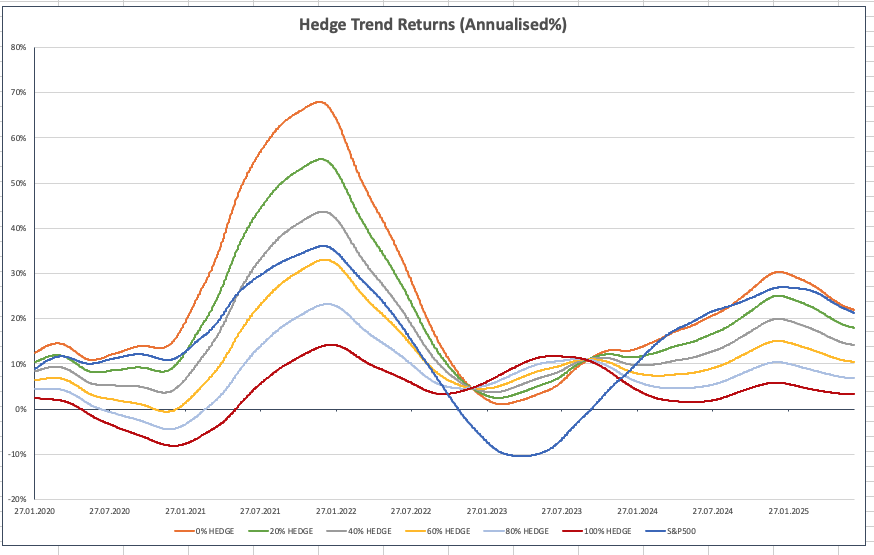

After last week’s discussion of Unknown Knowns, we update our findings and revisit the idea of how dynamically risk managing the portfolio’s exposure to underlying market risk can provide a more stable, compounding approach to investment returns.

Investment decisions are not just about Risk and Return – they are aboutindentifying the risks you DO NOT NEED TO TAKE. A focus upon the least appreciated of the Rumsfeld identities _Unknown Knowns – helps to shape our perception of the investment biases we do not need to follow if we want to maximise wealth.

After our latest portfolio rebalances we take a look at the “Weather” ahead