Knowing the when the where and the how is a powerful tool within the investment armoury.

All that glitters was gold.

Knowing the when the where and the how is a powerful tool within the investment armoury.

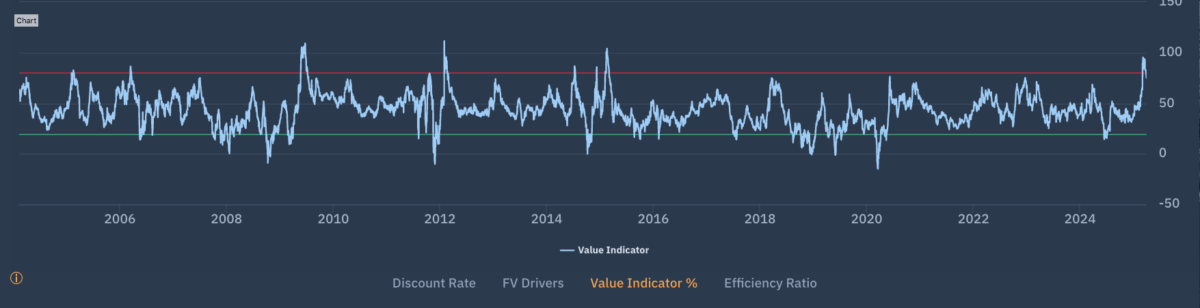

The Apollo momentum signal is a measure of the momentum associated with inter-temporal changes in stock level expected returns and the consequent re-estimation of future expected returns by the market. We refer to this as the (momentum) accelerator signal. The image shows the Accelerator (long) signal as seen on the Broadcom – this is one […]

The Need to Know – Always Since we created Apollo – 20+ years ago, we have come up with one of two great ‘strap lines’ for what we do and ‘The Need to Know’ was one of them on the basis that once you know, you know. You see, you understand and make a decision […]

According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

Reporting on what has been going on and why is one thing. Knowing what to do about it and when is another altogether.

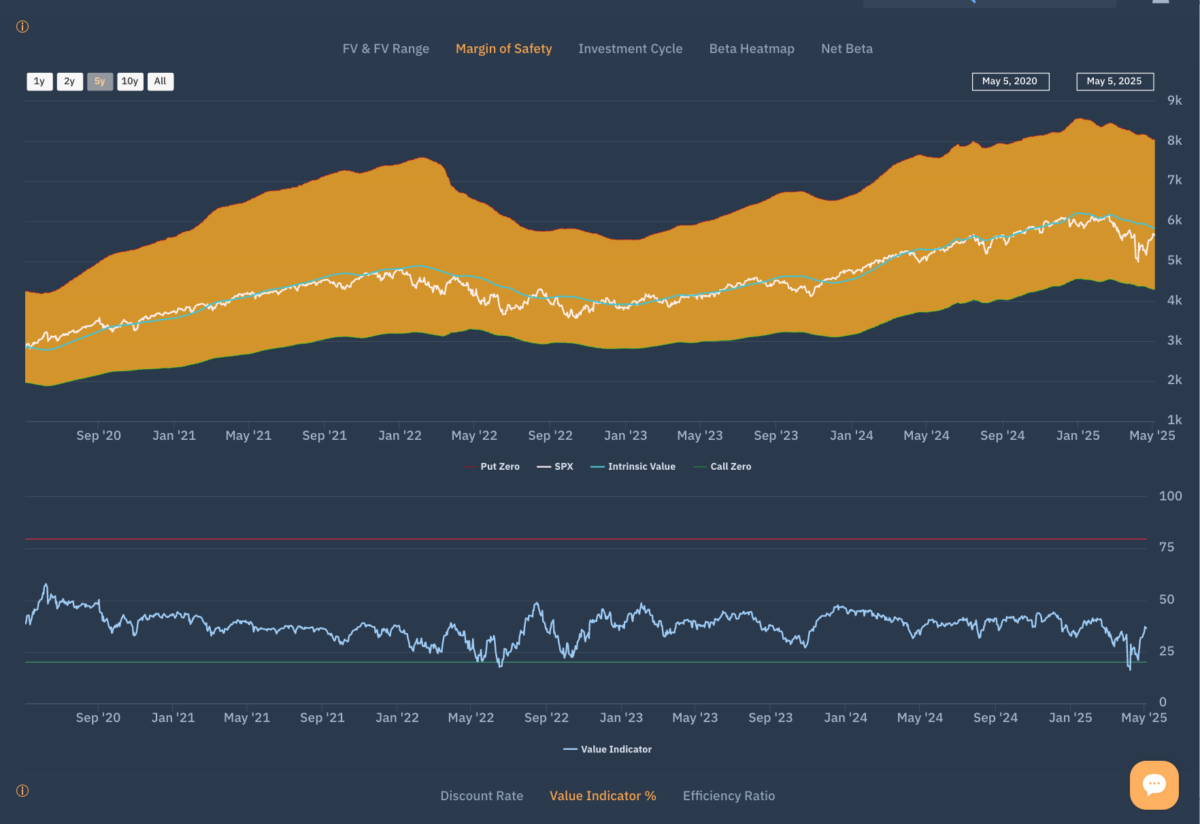

Everything we do at Libra is from ‘the bottom up.’ The sector and market signals are an aggregation from the signal stock level. Investors can start at the market level and cascade from sectors to stocks to see the best opportunities.

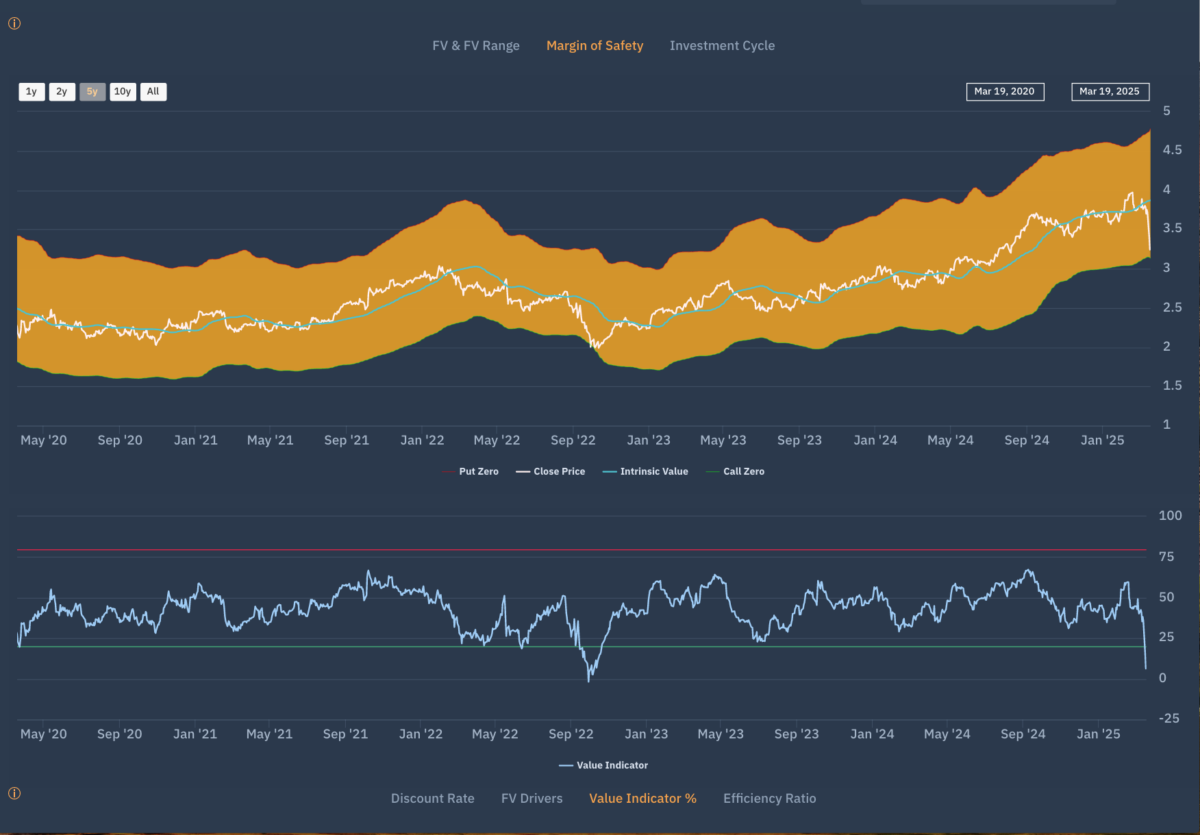

In the same way that many investment advisors failed to sell certain stocks when the time arose (see previous posts) they may not have the skillset or process that allows them gauge when to buy. In markets such as this, an answer is to be found in Benjamin Graham’s Margin of safety. The principle of […]

Knowing when to buy a stock is one thing but understanding the risk of loss is another skill altogether.

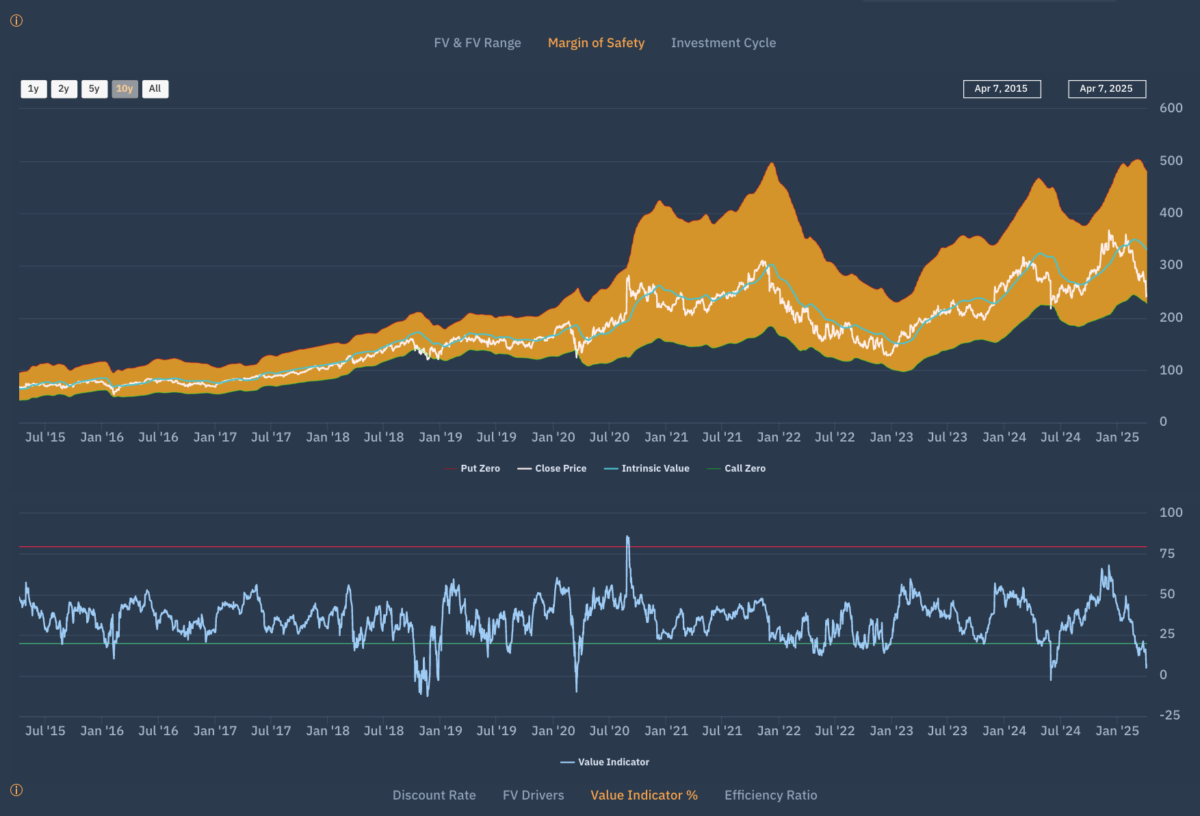

In May 2007 the sector traded at €200. During the GFC (Great Financial Crisis) the sector hit a low of €24 in March 2009 and from that moment until September 2023, the sector was an investor’s graveyard. In October 2022 Apollo deep value signals appeared equivalent to the GFC and Covid period. A Need to […]

As someone who has been around long enough to be following Tesco’s stock market journey since the late 1980’s I found myself bemused by the share price reaction to the news that Asda was on the verge of announcing a price war. Over the years we have got used to price wars, particularly the threat […]