As regular readers know, we like a sports analogy and so let’s think about horse racing for a moment. As a person who goes racing twice a a year for a good day out, I don’t follow racing like I follow other sports. I don’t research the race card before attending and yet I place a small bet on every race. It won’t surprise you to know that I tend to bet on the outsiders with ‘attractive odds.’

What I’m actually doing here is hoping that this particular horse will run the race of a life time or that the horses with shorter odds are going to pull up lame.

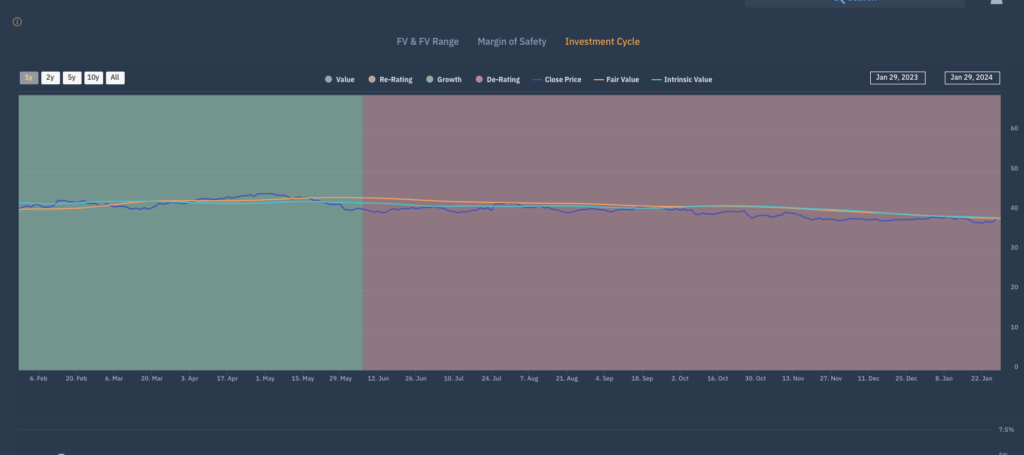

Anyone who has been ignoring the facts – be it a horse or a company and banks on a reversal of fortune based on conjecture and unknown external factors will fail. So to bring it back to stocks, if I bought Unilever or defensive stocks last year and at the beginning of this year, I did so against the odds. The chart below shows Unilever trading within the Apollo de-rating cycle and continuing to do so since June 2023.

What I’m actually doing is ignoring the fact that the winner of the race will more than likely have a history of winning based on pedigree, quality of stables and trainer and jockey. Winners win and my three legged nag brings up the rear, cue IBM. It’s been a stock to own because it’s been trading within the Re-rating cycle since July 2023.

Those who ignore the form or assume it can’t be sustained, just as they did last year and just as they are doing again this year are failing

At Libra, we provide the equivalent of the the Racing Post for investors using the Apollo signals and indicators. We back stocks, sectors and markets which have the best chance of outperforming and offering the best returns and we when we look at the race card, otherwise known as the stock universe, we kick out the losers – stocks being de-rated, value stocks and junk.

We pick from the stocks with form. Re-rating, Growth and if we pick Value names, there has to signs that they are going to find form and the market starts to recognise the potential and reward it. To go back to racing analogy – the odds are coming in.

Last year investors in the winning circle identified the winners, using a process of momentum – price for sure, but more importantly, FUNDAMENTAL momentum. There was no reason to change horses in mid stream at the end of the year and the same people who were in the winners circle are in the winner’s circle once again.