One of the most significant investment developments of recent years has been the emergence of factor-based investing as a mainstay of investment management. Although factor investing has been around for decades, the real trigger for its move to centre stage came after a detailed “Evaluation of Active Management of the Norwegian Government Pension Fund – Global” was commissioned by Norge Bank Investment Management (NBIM) in the wake of the 2008 financial crisis and published at the end of 2009.

This was a very comprehensive study covering the period 1998 to 2008, aimed at properly understanding the risk and return structures being operated by the Norwegian authorities and what might need to be revised in terms of their approach to Active Management in the light of (then) recent events. One of the main conclusions and recommendations of the paper was that the fund more explicitly align itself to the factor-based returns that it was already exposed to and that it might consider developing (in-house) a more systematic, factor-benchmark based investment approach in order to do so. It was arguably this single recommendation that was the catalyst for the widespread adoption of more passive, factor based style and Smart Beta investment related fund structures across the whole investment Industry.

The push for top-down management

The report’s enthusiasm for this shift in approach was primarily driven from the risk management side of the investment process and in particular the systematic risk associated with factors such as volatility and liquidity that had emerged in the 2008 financial crisis. What has perhaps been overlooked is that, whilst the contribution of active management in relation to fixed income had been zero on average, the active equity management part of the NBIM fund contributed a small but significantly positive proportion to fund returns and almost zero contribution to portfolio level risk. The suggestion that a top-down decision process should nevertheless be taken with regard to factor exposure across both equity and fixed income, as opposed, in the case of equities, to simply allowing it to emerge as a by-product of “bottom-up” stock selection from active management, highlights the emphasis that the report’s authors placed upon the ability to manage risk at the overall portfolio level including at the cross-asset level.

The fact that Active – not Passive – management was still recommended to be pursued with reference to these Equity related Benchmarks (but from a top-down perspective) also seems to have been forgotten:

“…First, the decision to deviate from long‐term strategic loadings on factors (e.g. a temporary shift from the target allocation to equities) and second, the decision to hold securities in weights that differ from factor benchmark weights. These roughly correspond to timing and selection, where the default, or the baseline case, is determined by factor portfolios that comprise the Fund benchmark”.

The real recommendation, therefore, was to favour the introduction of a top down, factor driven – as opposed to a “bottom-up” stock selection – approach to the Active Equity management part of the fund (revealing, perhaps the biases of the report’s own academically based methodologies). So, even though Active Equity management had done no wrong in regard to either risk or return (according to this evaluation study at least), it nevertheless set in train the whole Active vs. Passive debate, with Factor Benchmark indices being established as the new-kids-on-the-block in the form of essentially passive investment vehicles based upon back-tested methodologies.

Evolution but not – yet – revolution

What has evolved since 2010 is the establishment of a multitude of these types of factor benchmark indices – and Smart Beta variations of them – as (largely static) investment vehicles that essentially maintain passive exposure to Factors. The Efficient Market Hypothesis has been retained and factor-based Investing has become about Risk Management, not about achieving excess return. Timing and selection are seen as mostly “top-down” decisions to be made infrequently. The other development to note is that whilst (in theory, at least and certainly in line with the 2009 study’s proposals for NBIM) investors should allocate to long-short factor portfolios (value-growth, small cap-large cap, quality -junk) in order to benefit from a diversified portfolio approach, most factor based investors in reality tend to allocate to single Smart Beta type Factor products as “long only” strategies that take the form of “factor bets”.

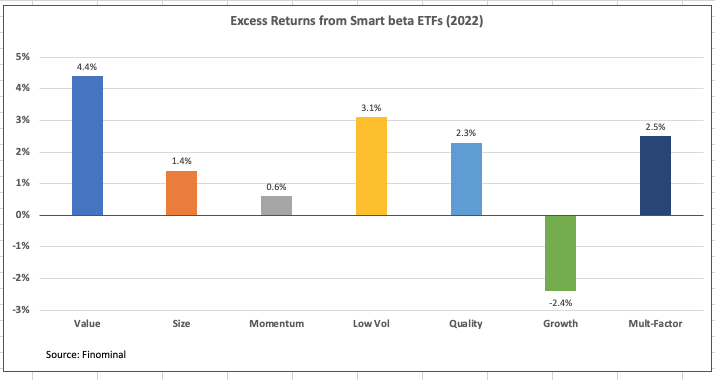

To say this approach has been problematic for investors in the intervening period is to put it mildly, but 2022 was different – virtually all factor-based Smart Beta strategies (apart from growth) appear to have outperformed their global benchmarks in 2022, to record their best performance in over a decade as a risk shock to growth stocks in response to the Fed aggressively raising US interest rates for the first time in a decade led to this pattern of excess returns. However, as the dust settles on this performance “success story”, it is worth thinking about what it actually indicates: When the whole collection of high-profile mega-cap stocks and long duration “future growth” stories collapsed over the course of 2022, it is hard to make the case for the positive excess returns to these other factor categories as being anything but a by-product of that sell-off. This, in turn suggests that the success of factor investing in 2022 was thus one of risk management – not return performance per se. A revisiting of the 2009 evaluation report underscores this point; factor analysis is, above all else, a risk management tool that allows the investor to be in a position to react to the kinds of unexpected developments seen in 2008 and, now again in 2022.

Top-down risk – bottom-up reward

The bigger question now, of course is what this implies for 2023. I would argue that although the interest rate and inflation shocks of 2021/22 are unlikely to be repeated in 2023, the need to retain a factor-based risk management approach is clear. However, it is also clear from the performance of the markets so far in 2023 that the ability to anticipate factor rotation is not straightforward, so trying to anticipate which factor might “outperform” another from a top-down perspective looks more like actively taking risk as opposed to seeking to manage it. That might not always be the case, but for now at least, taking deliberate factor tilts does seem difficult to rationalise.

The lessons from over a decade ago remain – maintaining a balanced exposure across investment factor categories (value, growth, quality, momentum, volatility) to help mitigate against unquantifiable external risk factors – is probably the best risk management framework to operate under in 2023 and beyond. For active equity managers, the source of any excess return will come from old fashioned stock selection from within these factor-based categories. Actively constructing and managing a portfolio from both the top down (risk management) AND the bottom up (excess return) perspective would seem to be the post 2022 blueprint for equity investment.